Konsep analisis teknikal menggunakan garis support dan resistance adalah hal paling dasar dan sering digunakan para trader. Support and resistance is the best trading strategy that is working well for more years.

Easy to Understand Price Action Trading My Trading Skills

Easy to Understand Price Action Trading My Trading Skills

It’s a basic and fundamental concept used to find levels of interest, manage high risk and place stops, and identify appropriate entry and exit positions.

Trading support and resistance. President’s day trading schedule 2021, mini nasdaq chart and futures support & resistance levels 2.11.2021 posted by: Support and resistance trading step 3 Trading support and resistance lines are critical for every trader to implement into their system.

Support and resistance are dynamic, and so your trading decisions based on them must also be dynamic. With candlestick charts, these “tests” of support and resistance are usually represented by the candlestick shadows. We had expected the level at 103.88 might act as resistance, as it had acted previously as both support and resistance.

Support and resistance trading method. Instead of simply buying or selling right off the bat, wait for it to bounce first before entering. Support and resistance levels can be identifiable turning points, areas of congestion or psychological levels (round numbers that traders attach significance to).

By doing this, you avoid those moments where price moves so fast that it slices through support and resistance levels like a knife slicing through warm butter. However, they often lack a clear method for taking advantage of market support and resistance. Support and resistance trading step 2.

In an uptrend, the last low and last high are important. As price action concepts go, support and resistance is one of the oldest in all of trading. Before going to support and resistance, you should know the meaning of “level”.

This support and resistance trading strategy is centered on the concept of trend pullback. Support and resistance trading key takeaways. Then, using the theory of support and resistance and false breakouts, positions are taken in the market.

When price breaks through a support or resistance, we wait until the price pulls back to the broken level. The complication is because there’s so much nuance to differentiating between random price levels and true support and resistance levels. Support and resistance levels can carve out trading ranges like we see in the chart below and they also can be seen.

Support and resistance play an important role in successful trading.these levels indicate at what moment the price of a share or forex pair is likely to move in the opposite direction. What is support and resistance? One of the basic characteristics that determines the value of a product, commodity and even a currency, forms an important aspect when it comes to technical analysis of the forex markets.

Support and resistance trading step 1. Often times you will see a support or resistance level that appears broken, but soon after find out that the market was just testing it. Get our trading strategies with our monthly & weekly forecasts of currency pairs worth watching using support & resistance for the week of february 8, 2021.

What is support and resistance? Support and resistance levels are horizontal price levels that typically connect price bar highs to other price bar highs or lows to lows, forming horizontal levels on a price chart. A support or resistance level is formed when a market’s price action reverses and changes direction, leaving behind a peak or trough (swing point) in the market.

Istilah ini digunakan untuk merujuk pada tingkat harga tertentu yang mencegah atau menjaga agar harga tidak terdorong ke arah tertentu. But, you should have to know the rules how to trade support and resistance properly. The higher the timeframe, the more relevant the levels become.

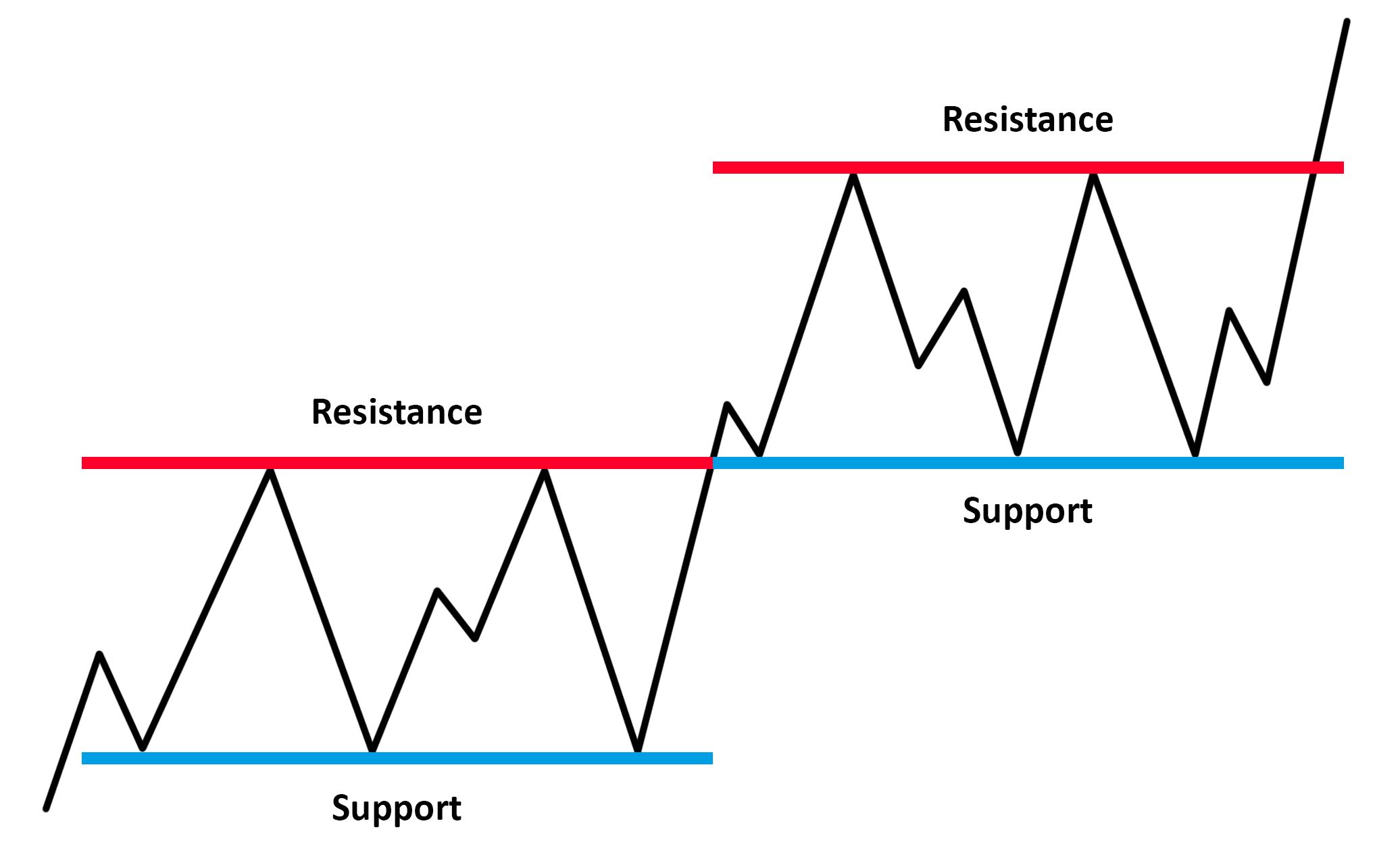

The price reacts to this newly formed support and start moving up again. For a trending market, the flipping of support into resistance and vice versa is a common occurrence. Support and resistance attracts a lot of attention from traders.

Oleh karena itu kali ini pintarsaham.id akan menjelaskan cara trading dengan support resistance. The idea is to buy when the asset hits the support level and short when it hits the resistance level.this method works very well. The best way is to trade using a channel.a good example is shown on the previous charts.

In this article, you will learn how to calculate support and resistance, identify support and resistance trading zones, stock support and resistance approach to trading, along with forex trading support and resistance. Konsep support dan resistance ini merupakan bagian dari menganalisis pola chart. Support dan resistance dalam trading saham.

There will be some looking to trade the reversal, and others looking to trade the breakout. A support and resistance trading strategy that lets you profit from losing traders. There are certain key support and resistance levels that can be watched on the more popular currency pairs this week.

There are several methods of using s&r. There are many different ways to identify these levels and to apply them in trading. When trading the bounce we want to tilt the odds in our favor and find some sort of confirmation that the support or resistance will hold.

While support and resistance is among the most straightforward concepts for traders to learn, profitable implementation is more complicated. How to trade with support and resistance. To build a systematic trading approach, we will take a look at “flipping support/resistance”.

Now, we going to see the best working support and resistance strategies step by step. Notice how the shadows of the candles tested the 1.4700 support level. Prices in a currency pair tend to fluctuate when there is an imbalance of supply and demand.

The first part of our forecast is based. Support and resistance levels are the most commonly used technical tools within a trading community. The levels have been used for (literally) centuries now, way before trading was even conducted online, and are still to this day one of the most popular trading techniques, mainly because of how useful they are.

Let us see how trading reversals from two of last week’s key levels would have worked out: Support and resistance are used by traders to refer to price levels on charts that prevent the price of an asset from getting pushed in a certain direction. If the price makes a lower low, it indicates a potential trend change, but if the price makes a new high, that helps confirm the uptrend.

Konsep support dan resistance merupakan dua atribut yang paling banyak dibahas dalam analisis. The price coming down now halts at the old resistance level which has now become support level. Support and resistance is a powerful pillar in trading and most strategies have some type of support/resistance analysis built into them.

This week we will begin with our monthly and weekly forecasts of the currency pairs worth watching. You can use these levels to find a good time to open a trade or investment.

Instantly Improve Your Trading Strategy with Support and

How to Trade Futures with Support and Resistance Levels

How to Trade Futures with Support and Resistance Levels

Trading support and resistance levels with price action

Trading support and resistance levels with price action

Support And Resistance Trading Full Explained ( हिंदी

Support And Resistance Trading Full Explained ( हिंदी

Support and Resistance support and resistance trading

Support and Resistance support and resistance trading

3 PROFITABLE Support & Resistance STRATEGIES (Advanced

3 PROFITABLE Support & Resistance STRATEGIES (Advanced

How to Use Support and Resistance Levels in Trading

How to Use Support and Resistance Levels in Trading

Support & Resistance The Trend Trading Blog

Support & Resistance The Trend Trading Blog

The Foundation of Trading Support and Resistance YouTube

The Foundation of Trading Support and Resistance YouTube

Flipping Support and Resistance for Swing Trading

The 3 Practical Uses of Price Congestion That Traders Miss

The 3 Practical Uses of Price Congestion That Traders Miss

The Most Comprehensive Article On Support and Resistance

The Most Comprehensive Article On Support and Resistance

Support and Resistance Forex Trading Tips YouTube

Support and Resistance Forex Trading Tips YouTube

Trading, Support and Resistance Explained!! — Steemkr

Trading, Support and Resistance Explained!! — Steemkr

How to trade Forex like a pro?

How to trade Forex like a pro?

Trading Support and Resistance with 100MA and 40MA Forex

Trading Support and Resistance with 100MA and 40MA Forex

Support and Resistance Trading Tricks Traders Bulletin

Support and Resistance Trading Tricks Traders Bulletin

How to Draw Support and Resistance the Easy Way

How to Draw Support and Resistance the Easy Way

Flipping Support and Resistance for Swing Trading